The markets and economy proved resilient in 2024. Despite numerous headwinds, stocks climbed to new highs and risk assets broadly performed well.

Read MoreFor many years, we have helped our clients with government pension plan around two policies that reduced or completely eliminated their Social Security benefits.

Read MoreSince Eclectic’s inception in 1984, investing in stocks has been a pillar of most (if not all) financial plans we put together for our clients with long term goals. We find it helpful to periodically step back and review the assumptions underpinning our long-term investment philosophy which is what follows in this article.

Read MoreWe hope this article presents a realistic view that falls somewhere in the middle. We also should clarify that by “pay 1%”, we mean a fee-only financial advisor who charges an annual fee starting at 1% of the amount they are managing. We don’t mean brokers or commission-based advisors who get paid from sales and transactions.

Read MoreAs we celebrate 40 years of serving our clients this year, we reflect on all the ups and downs we have experienced in the financial markets since Eclectic Associates was founded in 1984. While the world around us has evolved, our investment philosophy has remained consistent.

Read MoreHave you seen advertisements for title lock insurance and felt scared about having your home title stolen? We have had clients ask us about whether they should purchase title lock insurance and where one might purchase it.

Read MoreAt Eclectic, we focus on the long-term and not the short-term. We think it is impossible to predict the future. We value diversification.

Read MoreStocks ended the quarter at a new high, with the S&P 500 up 6%, led by dividend payers and utilities while tech stocks cooled off.

Read MoreWe want to make sure the new federal Beneficial Ownership Information (BOI) report to FinCEN is on your radar, if you are required to complete it.

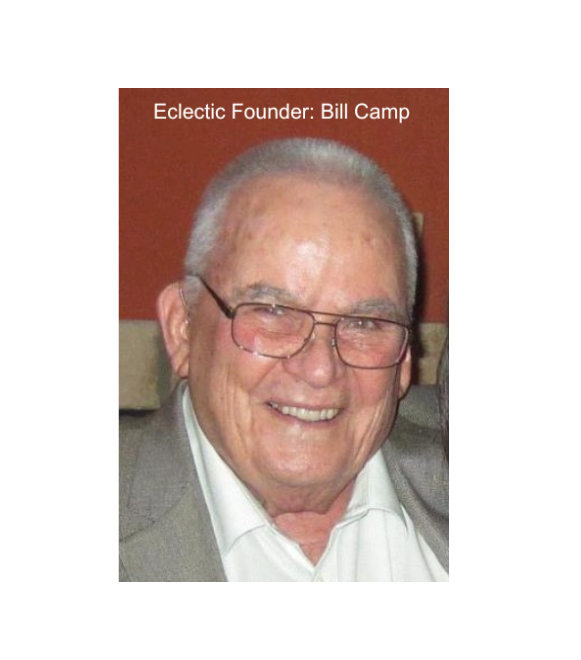

Read MoreOur founder, Bill Camp, originally was a farmer in the Central Valley of California before he changed careers and started Eclectic Associates. Farming is not easy: the days are long, it takes a lot of hard work, a crop is often totally dependent on the timing of rain, and sometimes the difference between success and failure is a narrow margin. Farming also teaches you things, whether you want to learn or not.

Read MoreThe vast majority of retirees say that they would like to stay in their own home for the duration of their retirement. This is often called “aging in place”. But for many people, there comes a point where they need to make hard decisions about their living situation and the future.

Read More“Being fee-only planners, we believe we offer our clients objective advice. We never receive commissions on anything we recommend.”

-Letter to a potential client from Bill Camp, December 1985

Read MoreStocks were mixed during the quarter, with the S&P 500 up 4%, led by tech stocks. The utilities sector has also posted remarkably good performance as investors expect strong electricity demand to power data centers for artificial intelligence (AI).

Read MoreBill Camp and his wife, Anita, decided on the company’s name in early 1984. Over a number of days they considered a lot of different names, but finally decided on the word “eclectic” while searching out words in the dictionary.

Read MorePerhaps you’re starting to see retirement and Social Security checks on the horizon. If you still have a mortgage, you may be wondering: “Should I plan on paying off this mortgage before retirement?

Read MoreGoing through a divorce can be emotionally challenging, but it’s crucial to address the financial aspects as well. Seeking professional financial advice during this process can significantly impact your future stability.

Read MoreEclectic Associates started in Fullerton, California in 1984, which makes 2024 our 40-year anniversary. In the world of financial advisors, that type of longevity is about as rare as a black bear swimming in a Fullerton pool - it can happen, but not very often!

Read MoreAs pointed out thousands of years ago, there’s nothing new under the sun. And indeed, the main structure of scams hasn’t changed much.

Read MoreEven though we all know we can’t predict the future, it doesn’t seem to stop us from trying. The news is filled with predictions and opinions from various “experts” doing the same thing.

Read MoreStocks started the year strong with the S&P 500 gaining 10%, continuing the late 2023 rally. Tech stocks led, while value stocks, especially in the energy and financial sectors, also saw robust gains.

Read More