Why does inflation matter?

Travis J. McShane, CFP®, CFA

A Disease

If you have ever met with Scott Rojas here at our office, you have likely heard him refer to inflation as the heart disease of personal finance. Although you might not feel the sting of price increases from year to year unless you are paying close attention, over long stretches of time inflation can become a severe headwind.

In recent memory, U.S. annual inflation has remained relatively subdued compared to the heights reached in the 70’s and 80’s. Below is a table illustrating the United States inflation rate over the past ten years as reported by the U.S. Bureau of Labor and Statistics:

Despite the low annual figures, the compounded effect of these numbers over the past ten years would have eroded the purchasing power of the dollar by 20.7%!

Calculating Inflation

To arrive at these inflation figures, the U.S. Bureau of Labor and Statistics constructs a basket of goods and services commonly purchased by U.S. consumers that is updated periodically and tracks the price increases over time. It is unlikely that your personal spending behavior mirrors the constructed basket exactly, so your personal inflation rate will vary from the headline inflation figures that are published.

The chart below illustrates price increases and decreases of various goods and services during the 20-year period ending in 2018. If you required hospital services or attended college during that period for example, you can see how your personal inflation rate is likely higher than the headline inflation figures.

Another note to keep in mind about U.S. inflation is that Congress has given the Federal Reserve a dual mandate to target price stability and maximum employment. The U.S. Federal Reserve is the institution responsible for setting monetary policy in the U.S., and they have previously defined price stability as an annual 2% static inflation target.

If you have been paying close attention to recent news, then you may have caught the slight course correction announced by the Fed as part of their Coronavirus response that updated the definition of price stability to an average of 2% annual inflation.

Keeping Up

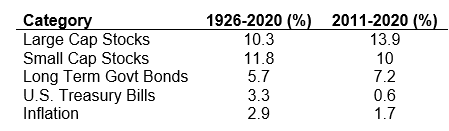

If we accept the premise that some level of inflation will likely continue, the next step is to consider our options for mitigating its effects over time. The chart below outlines a few major classifications of investments tracking back to 1926 (when reliable data became available) as well as the most recent ten-year period. The SBBI data is provided by Ibbotson Research.

From the chart, U.S. Treasury bills can be used as a proxy for money market accounts and other types of short-term cash savings. You can see that over the last ten years returns of Treasury bills have trailed inflation by 1.1% per year.

The remaining asset classes shown in the chart are what we would consider risk assets, and each of them have outpaced inflation over the periods shown. Keep in mind that this chart does not show the accompanying price swings experienced over the years to arrive at those average annual return numbers.

No Free Lunch

To illustrate the price volatility experienced in risk assets, consider the following chart constructed by JP Morgan Research of the S&P 500 since 1980 showing the returns achieved for the year (represented by the grey bar) along with the largest percentage drop during the year (represented by the red dot).

Internally, this is one of our favorite charts to review as it reiterates just how difficult it is to time the market with any success over a long period of time. If you or someone you know can reliably predict year in and year out when each one of those red dots will occur, please have them give me a call as I want to hire them as my advisor/lotto number provider.

For the rest of us, the approach we have adopted to guide hundreds of families to and through retirement is to first construct a broadly diversified portfolio of several different asset classes. Next, check to make sure near-term distribution needs from the portfolio are accounted for using lower risk investments. Then, organize the remaining portfolio in asset classes that give you an opportunity to outpace inflation over your unique investing time horizon.

Over your time horizon, we are certain that the markets will go up and down. Instead of trying to time peaks and valleys by selling to cash and then jumping back in, we rebalance through them in a disciplined fashion to control risk, take advantage of the opportunities presented, and capture the returns that the capital markets provide during your investing horizon.

The Final Word

I will leave you with a quick sketch by Carl Richards, a well-known presenter in the advisor community, that illustrates the trap we fall into when we convince ourselves we can predict the future:

As always, if you have friends or family that you think would benefit from a conversation with us, please do not hesitate to send them our way. We are happy to spend some time on the phone with them, or if they want take advantage of a one-hour complimentary office appointment, all the better. They can book time directly on our calendars here: 15-minute discovery call