Tax Tips

By Aimee Calderon, CFP®

It’s that time of year again. Tax Time. April 15th has come and gone but the IRS has granted Americans more relief by moving the 2020 tax return deadline to May 17, 2021. Some tax rules were changed for 2020 due to COVID. As you work on your taxes or with your accountant to complete your return and plan for 2021, here are a few things to watch for.

RMDs

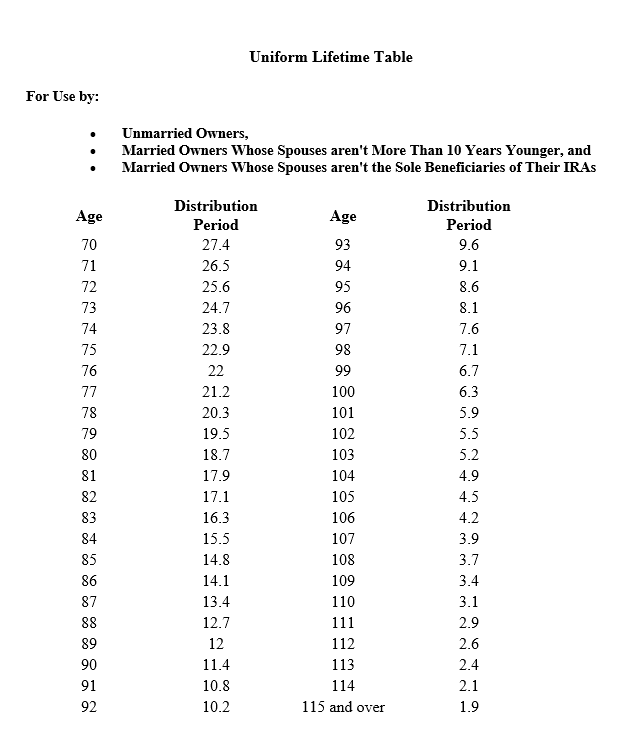

In 2020, the Required Minimum Distributions (RMDs) from retirement plans were waived. This helped many people, who didn’t need the money out of their retirement account, lower their taxable income and therefore lower their income tax. RMD rules have returned to normal for 2021. If you are age 72 or older, you must take your required distribution from your retirement account in 2021. The RMD is calculated by dividing the value of your account on 12/31/20 by your life expectancy which is determined by the IRS. Most individuals will use the IRS Uniform Lifetime Table.

Qualified Charitable Distributions (QCD)

Qualified Charitable Distributions (QCDs) have been around for a while but they became more beneficial since the standard deduction was increased in 2017. Many retired Americans, who don’t have a mortgage anymore, use the standard deduction on their taxes thereby eliminating any tax benefit for charitable gifts from taxable accounts. However, if you make a QCD from your IRA account, you can still get a tax benefit. QCDs are not taxable distributions and directly reduce the amount of your annual RMD. There are several rules for QCDs to watch for.

- You must be at least age 70 ½ to make a QCD

- The maximum dollar amount of QCD’s for an individual is limited to $100k per year

- Ongoing SEP and SIMPLE IRA’s do not qualify for QCDs

- QCD’s must be made directly from the IRA account to a public charity

- They cannot be made to a Donor Advised Fund

Many of our clients take advantage of the benefits of QCDs. They enjoy turning taxable income into a tax-free gift that they already planned to give to charity.

Retirement Contribution Credit (Saver’s Credit)

If you had lower income in 2020, you may be able to take advantage of this credit. For Married Filing Jointly couples with AGI between 42,501 and $65,000 in 2020, a credit of 10% is available. Those with lower income can get up to a 50% credit. Please note that the maximum contribution that may qualify for the credit is $2,000 for individuals ($4,000 if married filing jointly). Contributions to both employee retirement plans and both traditional IRA and Roth IRA plans qualify for the credit.

Here is a chart from the IRS website showing the breakdown on the credit amounts:

If your income was low in 2020, you may not have discretionary income to make these contributions for 2020, but if you have a taxable investment account, you can use it to fund to an IRA or Roth IRA to take advantage of this credit.

Child Tax Credit

Part of the third stimulus bill passed this year increases the child tax credit from $2,000 per child to $3,000 per child or $3,600 per child under 6 years old. This increased credit only applies to families (married filing joint) with AGI under $150,000. For AGI over $150,0000, the increased credit is reduced by $50 for every $1,000 of income over the limit. Note that the normal credit of $2,000 still has a higher income threshold of $400,000 for married filing joint.

In addition to the increase, the child tax credit for the 2021 tax year will be pre-paid to families. Half of the credit will be paid in monthly payments from July 2021 to December 2021. The other half of the credit will be taken on the 2021 tax return next April. This seems like a great way to help families, but they might be caught off guard next April when they file their taxes and find out they owe money. For example, we have a client with 3 children between ages 7-17. Their total credit will increase from $6,000 to $9,000 for 2021. Half of the increased credit ($4,500) will be paid to them in 2021. They will receive monthly checks of $750 from July to December.

We often help clients figure out how much they should withhold during the year for taxes so they can get close to even on their tax bill. The child tax credit is considered when we make withholding recommendations. The client above is withholding taxes based on the assumption of receiving a $6,000 child tax credit on their return. Next year, they will only get half of the credit on the return ($4,500 instead of the $6,000 we planned on) because they already received the other half this year. If we did our projections correctly, they will mostly likely owe $1,500 in taxes next April. So, instead of spending all of the monthly payments they receive this year, they should save some for their taxes due next April or even make estimated payments to cover their tax liability.

The IRS is creating an online tool where you can update your information. If you have a child in 2021, you can use the online tool to notify the IRS. You can also use the online tool to opt out of the advance payments. If you are not eligible for the increased credit and you have fine-tuned your withholdings with the normal $2,000 credit in mind, it is probably best to opt out and avoid the headache of paying back the credit next April. This IRS online tool should be up and running by July.

We hope this information is helpful. If you have specific questions about your situation, please schedule a 15-minute discovery call with a fee-only financial advisor.